China top supplier of products containing critical raw materials

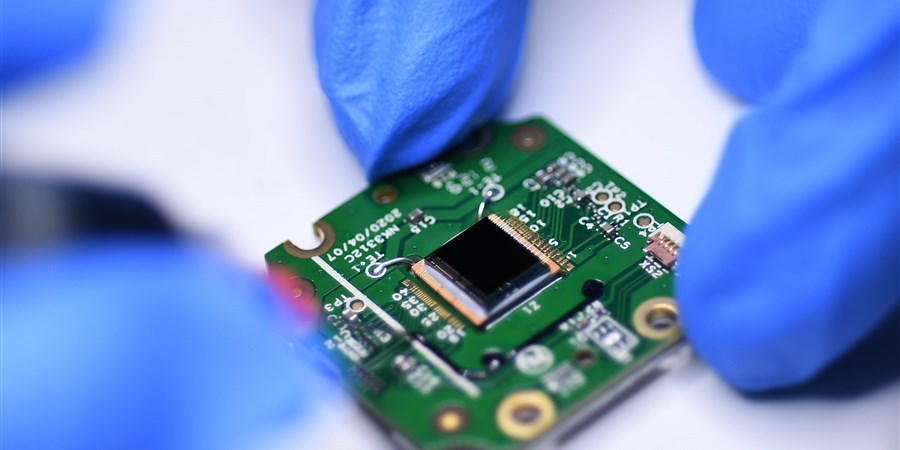

Critical raw materials (CRMs) are found in a large number of products and are required in, among other things, the sustainability transition (e.g. solar panels) and digitalisation (e.g. microchips).

In 2022, Dutch imports of products from China containing CRMs stood at 78.6 billion euros. This is more than from Germany, the second largest supplier with a gross product value of 48 billion euros. However, over half of these imports from China are immediately re-exported and remain in foreign ownership (quasi-transit trade). If this flow is excluded, Germany is the top supplier. On the other hand, a part of the products from Germany also contains CRMs from China.

Examples of products with CRMs that represent a high import value are laptops and tablet computers, telephones, computers and components, cars and components, solar panels, and batteries. Many of these products come from China, especially laptops, tablet computers, telephones, and solar panels.

| Land | Excl. quasi-transit trade (bn euros) | Quasi-transit trade (bn euros) |

|---|---|---|

| China | 38.1 | 40.5 |

| Germany | 43.6 | 4.4 |

| United States | 24.2 | 6.3 |

| Belgium | 18.1 | 0.4 |

| United Kingdom | 10.8 | 1.9 |

| Japan | 6.7 | 2.2 |

| France | 7.3 | 0.8 |

| Poland | 5.8 | 1.9 |

| Italy | 7.2 | 0.3 |

| Taiwan | 5.3 | 2 |

| Source: CBS, partly based on the Resources scanner by TNO and RVO. | ||

China top producer of 14 CRMs

China’s leading position confirms the overall picture that the country plays a key role in global supply chains of critical raw materials. This concerns not only mining and processing of the materials but also the production and trading of goods manufactured from these materials. For example, China is the largest producer of 14 different CRMs including gallium, germanium, natural graphite, and rare earth elements. In addition, China controls various mines in other countries, such as the cobalt mines in Congo. As a result, the EU as a whole largely depends on China for CRMs, both processed and unprocessed.

Russia largest direct supplier of CRMs

CRMs are also imported in unmodified or unprocessed form. The main country of origin in these direct CRM imports by the Netherlands is Russia. This does include the strategic but not-critical materials, such as copper and nickel (see explanation of critical raw materials)<link>. These CRM imports amounted to almost 1.2 billion euros (excluding quasi-transit trade) in 2022. The import value more than doubled relative to 2021, the year before the outbreak of war in Ukraine. As of 2023, the value of imports from Russia, for that matter, has declined significantly.

The CRMs from Russia with the highest shares in import value last year were copper (56 percent), nickel (27 percent), phosphorus (7 percent), coking coal (5 percent), and cobalt (4 percent).

After Russia, the largest CRM suppliers to the Netherlands are Australia and the United States (mostly coking coal).

| Copper (million euros) | Nickel (million euros) | Other (million euros) | |

|---|---|---|---|

| 2002 | 61.7 | 19.8 | 30.5 |

| 2003 | 25.9 | 63.2 | 35.2 |

| 2004 | 33.8 | 82.0 | 46.4 |

| 2005 | 29.1 | 66.7 | 68.6 |

| 2006 | 48.4 | 233.3 | 41.6 |

| 2007 | 29.4 | 251.9 | 44.2 |

| 2008 | 7.1 | 136.2 | 71.4 |

| 2009 | 16.4 | 50.1 | 72.1 |

| 2010 | 4.8 | 239.4 | 110.6 |

| 2011 | 4.5 | 251.2 | 82.1 |

| 2012 | 2.1 | 204.4 | 55.5 |

| 2013 | 6.2 | 124.1 | 40.4 |

| 2014 | 5.2 | 108.8 | 49.4 |

| 2015 | 49.6 | 97.7 | 34.2 |

| 2016 | 98.0 | 85.8 | 69.9 |

| 2017 | 129.5 | 88.5 | 83.7 |

| 2018 | 158.3 | 102.5 | 96.9 |

| 2019 | 139.3 | 56.7 | 120.7 |

| 2020 | 75.3 | 65.6 | 125.0 |

| 2021 | 265.4 | 77.9 | 173.9 |

| 2022 | 649.4 | 316.9 | 202.1 |

Russia also largest indirect supplier of CRMs

Not only directly but also indirectly, Russia is the most important supplier of critical raw materials. For example, when China supplies products to the Netherlands containing CRMs and these originate from Russia, it means Russia is an indirect supplier. Likewise when stainless steel imports from the US contain nickel from Russia; or when imports from Germany contain copper from Russia that was processed in Germany.

In this analysis, the largest CRM import from Russia is coking coal, followed by platinum metal, copper, phosphorus, nickel, and cobalt.

The most recent figures available refer to 2019 with indirect imports from Russia worth approximately 300 million euros, approximately comparable to the value of direct imports from Russia that year.

| Category | Coking coal (million euros) | Phosphorus (million euros) | Cobalt (million euros) | Copper (million euros) | Nickel (million euros) | PGM (million euros) | Silicon metal (million euros) | Other (million euros) |

|---|---|---|---|---|---|---|---|---|

| Russia | 123.41 | 28.45 | 12.82 | 41.37 | 24.69 | 46.98 | 0.70 | 15.61 |

| United States | 65.47 | 0.04 | 2.98 | 17.00 | 5.41 | 38.88 | 4.14 | 10.07 |

| Australia | 85.70 | 0.01 | 1.36 | 13.72 | 11.66 | 0.02 | 0.75 | 9.41 |

| Germany | 9.89 | 0.02 | 3.35 | 33.32 | 5.98 | 39.55 | 4.77 | 11.82 |

| Chile | 0.15 | 0.00 | 0.88 | 81.03 | 0.00 | 0.00 | 0.00 | 13.53 |

| Canada | 16.85 | 0.00 | 21.96 | 14.50 | 18.49 | 0.16 | 0.18 | 13.30 |

| China | 3.70 | 0.03 | 5.61 | 15.17 | 3.94 | 1.13 | 6.62 | 36.07 |

| Source: CBS, Eurostat, OECD | ||||||||

Sources

- Publication - Critical raw materials in the Dutch supply chain (in Dutch only)

- European Union - Study on the critical raw materials for the EU 2023

Related items

- News release - The Netherlands largest importer of Chinese solar panels

- The Netherlands in numbers - What do we import from China?