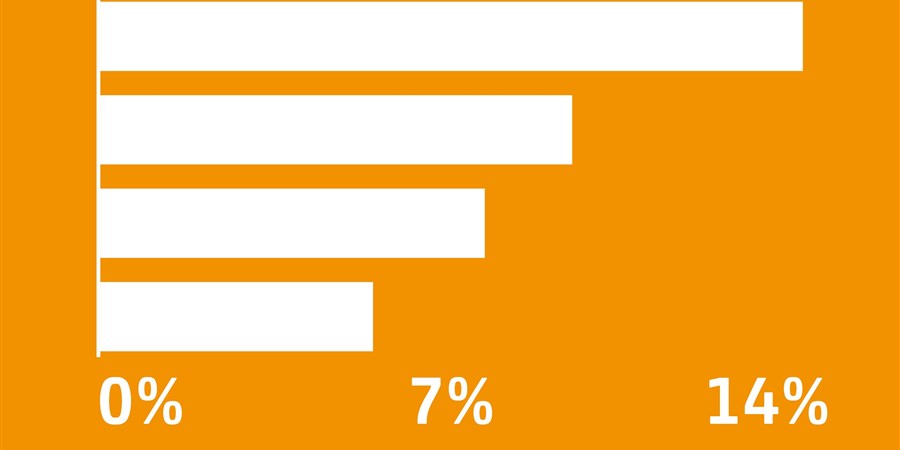

House prices vary considerably by region

| Change | |

|---|---|

| Amsterdam | 14.6 |

| Utrecht | 9.8 |

| The Hague | 8 |

| Rotterdam | 5.7 |

| Noord-Holland | 7.4 |

| Utrecht | 5.7 |

| Zuid-Holland | 4.7 |

| Limburg | 3.8 |

| Flevoland | 3.6 |

| Noord-Brabant | 3.3 |

| Overijssel | 3.2 |

| Gelderland | 3 |

| Friesland | 2.6 |

| Groningen | 2.4 |

| Drenthe | 2.2 |

| Zeeland | 0.8 |

House prices soaring in major cities

Year-on-year, prices of owner-occupied houses soared in the four major cities in the Netherlands, particularly in Amsterdam, where house buyers paid nearly 15 percent more on average than one year ago. House prices in Utrecht, The Hague and Rotterdam were also above the nationwide average.

Partly due to price developments in the four major Dutch cities, the average price increase in the Randstad provinces is much higher than in the rest of the country. Owner-occupied houses in the province of Noord-Holland were more than 7 percent up from one year previously, versus nearly 6 and nearly 5 percent respectively in the provinces of Utrecht and Zuid-Holland. In the provinces outside the Randstad region, the price increase is below the nationwide average. With less than 1 percent year-on-year, the lowest price rise was recorded in the province of Zeeland.

Residential property prices Amsterdam higher than in pre-recession era

Amsterdam is the only region where house prices have been on a pre-recession level in the last two quarters. In Q2 prices were nearly 7 percent above the record level of 2008. In the other cities, prices are still below the pre-crisis level.

Amsterdam is popular among potential house buyers. The overall value of residential property sold in Amsterdam in Q2 stood at 1 billion euros, i.e. nearly the same amount as for the other three major cities together. The aggregate value in Utrecht, The Hague and Rotterdam was 1.1 billion euros.

Prices flats nearly 7 percent higher

All types of dwellings are more expensive than one year ago. With nearly 7 percent, flats showed the highest price increase. This is partly due to price developments in the large cities, where flats constitute a relatively large part of the housing stock. The price increase for relatively more expensive types of dwellings, like detached and semi-detached houses was below average.

| Change | |

|---|---|

| Flats | 6.8 |

| Corner houses | 5.4 |

| Terraced houses | 5.1 |

| Semi-detached houses | 4.4 |

| Detached houses | 2 |

Current situation on the housing market has upward effect on prices

Prices of owner-occupied houses (excluding new constructions) were 4.4 percent higher in Q2 2016 than in Q2 2015. This is the most substantial price rise since the onset of the crisis in 2008. Various factors play a part in this respect. Earlier this week, the Kadaster already announced that the number of house sales had grown in Q2. Simultaneously, the period between introduction of an object on the housing market and the sale thereof and the number of houses for sale diminished. Potential buyers were also more eager to buy and the mortgage interest rate declined year-on-year.