Confidence among manufacturers down slightly

Producer confidence in July was below the 20-year average of -1.3. It reached an all-time high (10.4) in October 2021 and an all-time low (-31.5) in April 2020.

| year | month | balance (average of the component questions) |

|---|---|---|

| 2020 | August | -7.8 |

| 2020 | September | -7 |

| 2020 | October | -7.7 |

| 2020 | November | -6.4 |

| 2020 | December | -3.2 |

| 2021 | January | -1.8 |

| 2021 | February | -2.6 |

| 2021 | March | 0.6 |

| 2021 | April | 3.6 |

| 2021 | May | 5.6 |

| 2021 | June | 7.8 |

| 2021 | July | 9.2 |

| 2021 | August | 7.1 |

| 2021 | September | 9.1 |

| 2021 | October | 10.4 |

| 2021 | November | 10.1 |

| 2021 | December | 7.3 |

| 2022 | January | 6.5 |

| 2022 | February | 5.8 |

| 2022 | March | 5.7 |

| 2022 | April | 7.2 |

| 2022 | May | 5.8 |

| 2022 | June | 4.2 |

| 2022 | July | 5.3 |

| 2022 | August | 2.4 |

| 2022 | September | 1.2 |

| 2022 | October | 0.9 |

| 2022 | November | 1.1 |

| 2022 | December | 1 |

| 2023 | January | 1.1 |

| 2023 | February | 0.9 |

| 2023 | March | 0.9 |

| 2023 | April | -0.3 |

| 2023 | May | -1.7 |

| 2023 | June | -2.7 |

| 2023 | July | -2.7 |

| 2023 | August | -4.6 |

| 2023 | September | -3.9 |

| 2023 | Oktober | -3.7 |

| 2023 | November | -2.6 |

| 2023 | December | -5.7 |

| 2024 | January | -4.4 |

| 2024 | February | -4.2 |

| 2024 | March | -4.8 |

| 2024 | April | -3.6 |

| 2024 | May | -2.8 |

| 2024 | June | -2.4 |

| 2024 | July | -2.7 |

More negative about stocks

Manufacturers were more negative about their current stocks of finished products. However, they were positive about expected output for the next three months. Their assessment of the order positions remained virtually the same.

One component indicator was positive: manufacturers who anticipated an increase in output over the next three months outnumbered those expecting a decrease.

Two component indicators were negative. Manufacturers were more likely to indicate that their order position was weak rather than strong for the time of year, and more manufacturers described their current stock of finished products as large rather than small.

| July (balance % positive answers and % negative answers) | June (balance % positive answers and % negative answers) | |

|---|---|---|

| Producer confidence | -2.7 | -2.4 |

| Expected output | 10.4 | 9.5 |

| Assessment of stocks of finished products | -5.8 | -4 |

| Assessment of order-book levels | -12.7 | -12.8 |

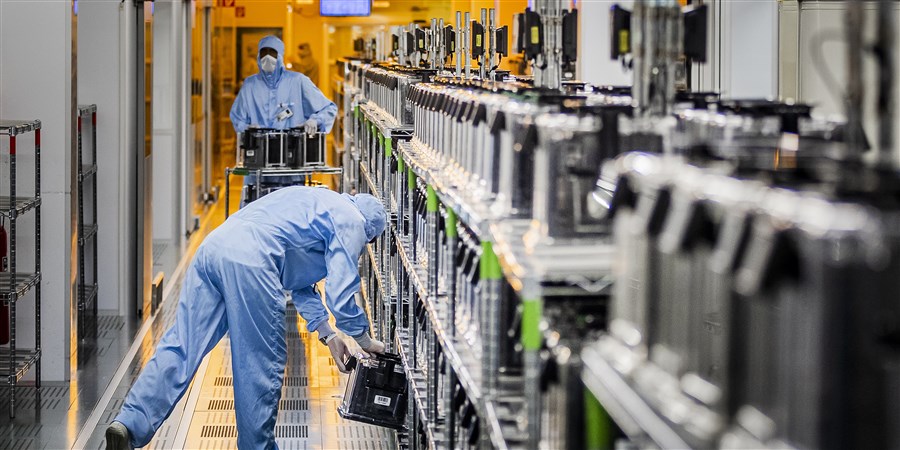

Producer confidence most positive in the electrotechnical and machinery sector

Confidence deteriorated in half of the main industrial sectors. Manufacturers in the electro-technical and machinery sectors were again the most positive.

| July (average of the component questions) | June (average of the component questions) | |

|---|---|---|

| Electrotechnical products and machinery | 4.6 | 2.8 |

| Petroleum and chemicals | -3.1 | -4.8 |

| Metal | -5.7 | -3 |

| Food, beverages, tobacco | -6.7 | -4.7 |

| Timber and building materials | -7.5 | -5.7 |

| Paper and printing | -8.3 | -1.5 |

| Transport equipment | -9.9 | -10.5 |

| Textiles, clothes, leather | -11.1 | -11.1 |

Capacity utilisation rate decreases

The industrial capacity utilisation rate stood at 78.0 percent at the start of Q2 2024, compared with 79.6 percent in the previous quarter. That is the lowest rate in four years.

| Capacity utilisation rate (%) | ||

|---|---|---|

| Quarter 4 | 79.2 | |

| 2021 | Quarter 1 | 80 |

| 2021 | Quarter 2 | 81.7 |

| 2021 | Quarter 3 | 84.1 |

| 2021 | Quarter 4 | 83.8 |

| 2022 | Quarter 1 | 83.6 |

| 2022 | Quarter 2 | 84.2 |

| 2022 | Quarter 3 | 84.2 |

| 2022 | Quarter 4 | 82.7 |

| 2023 | Quarter 1 | 82.6 |

| 2023 | Quarter 2 | 82.5 |

| 2023 | Quarter 3 | 81.6 |

| 2023 | Quarter 4 | 81 |

| 2024 | Quarter 1 | 78.4 |

| 2024 | Quarter 2 | 79.6 |

| 2024 | Quarter 3 | 78 |

Manufacturing output down by 3 percent in May

In May 2024, the calendar-adjusted output of the Dutch manufacturing sector was 3.0 percent lower than it was in May 2023. Year-on-year output also contracted in the preceding ten months. After adjustments for seasonal and calendar effects, manufacturing output fell by 0.4 percent relative to April.

Sources

Related items

- Dossier - Business cycle